How It Works

As whiskey matures inside the cask, it develops depth, complexity, and richness that significantly enhance its desirability among enthusiasts. The aging process transforms the spirit, creating an asset that appreciates over time, offering investors the potential to generate returns as casks reach their peak value.

Invest in new make bourbon

Hold barrels while they age

Sell the matured barrels of bourbon

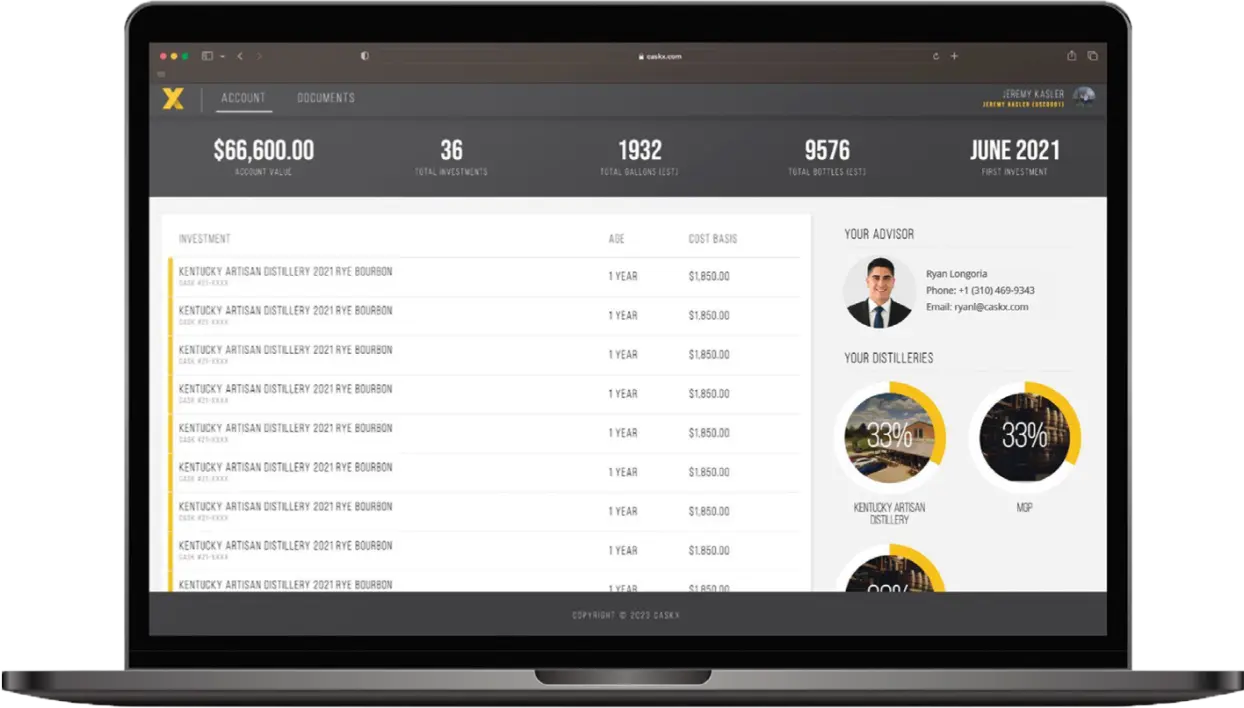

CaskX empowers investors with real-time insights into their whiskey cask holdings through an online management portal. This secure, web-based interface, allows investors to effortlessly monitor the value of their investments, access ownership certificates, review stock take reports, and stay informed with up-to-date valuations - ensuring complete transparency and control over their portfolio.

CaskX investors play a pivotal role in bringing the next generation of fine bourbon to life. The bourbon that will be sipped in the coming years may very well exist because of the foresight of today's barrel investors. This unique relationship between investors and distilleries is paving the way for older, more mature bourbons to become the norm rather than the exception. It's an investment that not only promises potential financial returns but also enriches the entire bourbon community by elevating the quality and variety of what's available to enthusiasts.

CaskX carefully selects distilleries to partner with by evaluating their story, brand reputation, projected future demand, product quality, and the expertise of the team behind the distillery. Only those meeting our strict criteria are chosen as investment offerings.

Investors hold the whiskey casks as they age over time, with the potential to observe capital growth as the spirit inside becomes older and more desirable. CaskX takes a long-term buy and hold strategy, with storage included for up to 8 years.

Investors have the flexibility to sell investments any time after the SEC mandated one year holding period. CaskX monitors holdings to recommend the optimal time to sell.

CaskX recommends a selling price for casks based on available market data. Investors can leverage a network of cask buyers including bottlers and brands to exit their holdings.

Distilleries sell casks to raise capital to fund operations given the long aging period required for whiskey production.

Large quantities of whiskey casks are purchased in bulk from carefully vetted distillery partners.

Smaller parcels of whiskey casks are offered as investments to qualified investors.

Holding casks for a 4-8 year term is recommended based on capital growth observed historically. Storage and insurance is included for 8 years.

Investors can sell holdings any time after an SEC mandated one year holding period. CaskX can assist in selling casks through a network of brands and bottlers.

Investors receive a cash payout, less a nominal trading fee, from the value realized on the sale of the casks.

CaskX has built strong long term relationships with distilleries across the United States as a component of the overall investment platform. In 2024, CaskX surpassed sales of more than 30,000 bourbon casks from a combination of distilleries varying in size and production capacity.

By working directly with distillers, CaskX attempts to secure better opportunities for investors. These connections are also expected to provide additional monetization strategies through distillery buy-backs and bottling arrangements when investors are ready to liquidate their holdings.

CaskX ensures a seamless investment experience by including secure storage and comprehensive insurance for bourbon barrel investments for the first eight years at the distillery’s warehouse, allowing the bourbon to mature without annual capital outlays. Additionally, CaskX investors have the exclusive opportunity to sample bourbon directly from barrels being at the distilleries, offering a unique, hands-on connection to investments as the spirit’s flavor profile evolves over time.

CaskX allows clients to get hands on with their investments by offering exclusive VIP tours to partner distilleries. This is the rare opportunity to go behind the scenes of the production process, meet the distilling team and draw samples right from the barrel. It's an unforgettable experience that offers a new perspective on the industry.

Due to the many years required to mature whiskey, the casks have long been sold as a way for distilleries to generate the cash flow needed to fund operations. However, these casks have traditionally been difficult for private individuals to acquire directly and the secondary market is generally burdened by high fees and a lack of transparency. By partnering directly with carefully vetted bourbon and scotch distilleries, Cask is making it easy for investors to access investment offerings from bourbon distilleries in the United States and scotch distilleries abroad. These investments play a critical role in the future success of the industry by providing three key benefits to distillery partners.

CASHFLOW

Any business, including both an established and new distillery, needs cash to run. Whiskey, however, needs to mature for a period of time before it develops the flavor profile that buyers demand. During this important time when the casks are aging, distilleries choose to sell new make and young casks in order to remain operational. This is where investors come in. Selling casks keeps the lights on for new, exciting distilleries, and investors make that a possibility.

INCREASED DISTRIBUTION

Independent bottling companies purchase casks from distilleries in bulk, blend the whiskey, bottle it, and build new brands. Most bottlers select only the finest casks and have built powerful product ranges centered around strict quality standards. By selling casks to these brands, the distillery can further grow their distribution and increase distillery recognition among consumers.

BRAND GROWTH

Beyond monetary aspects, selling interests in casks to investors and independent bottlers helps distilleries diversify and reach out further, which generally allows them to take their brand to the next level. Casks sales, auctions, and independent bottlers may add value to a brand, which can drive bottle and cask prices up.

Gain access to our 2024 State of the Market report. Tailored for investors, we cover strategic analysis, performance metrics, and the evolving dynamics of the whiskey market.

We’re making it possible for everyone to invest in bourbon barrels & scotch whisky casks from leading distilleries.

Sign Up For Newsletter

Go to top

SAFE HARBOR STATEMENT – Certain statements on this website represent forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual profits or financial results you may receive from your investment in a whiskey cask to be materially different from the future profits or financial results as expressed or implied by such forward-looking statements. CaskX has attempted to identify these forwarding looking statements with the words “believe,” “estimate,” “continue,” “seek,” “plan,” “expect,” “intend,” “anticipate,” “may,” “will,” “could” and other similar expressions. Although these forward looking statements reflect our expectations related to your potential profits and financial results in connection with the investment in a whiskey cask, such forward looking statements are based on information now available to us, which is subject to change, and they are inherently subject to certain risks and uncertainties. These risks and uncertainties including, but are not limited to the following: the highly regulated nature of the whiskey industry and the requirements that may be imposed on you due to changes in law after you acquire your whiskey cask; changes in consumer and commercial demand for whiskey; loss of whiskey due to evaporation or failure to appropriately monitor the cask as it is maturing; loss of whiskey due to leakage, damage or theft, competition for the sale of whiskey with other investors or distilleries having greater resources than you; negative perception for the distillery who manufactured the whiskey in your cask or lack of brand loyalty; and lack of public market for whiskey casks and the requirement to hold your investment for quite some time due to the long maturation of whiskey and applicable United States securities laws. Please review our Notice to Investors and related Risk Factors for a further description of these and other factors you should consider before making an investment in whiskey casks. CaskX is under no obligation to update any of the forward looking statements after the date of publication for this website and associated documents to conform such statements to new information.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

Google reCAPTCHA helps protect websites from spam and abuse by verifying user interactions through challenges.

ZOHO is a comprehensive suite of cloud-based applications for business management, collaboration, and productivity.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Vimeo is a video hosting platform for high-quality content, ideal for creators and businesses to showcase their work.

Service URL: vimeo.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

Facebook Pixel is a web analytics service that tracks and reports website traffic.

Service URL: www.facebook.com (opens in a new window)

A social media platform for discussion, sharing content, and community engagement across various topics and interests.

X Pixel enables businesses to track user interactions and optimize ad performance on the X platform effectively.

Service URL: x.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy.