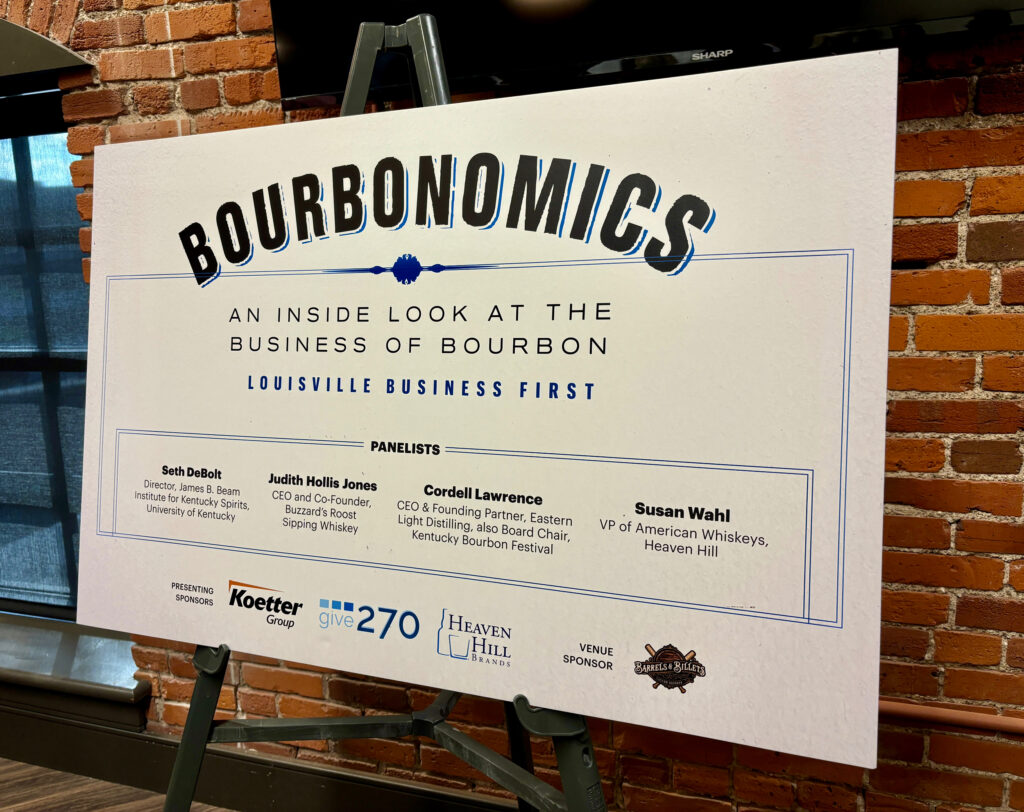

Last month, I was fortunate to attend an event titled “Bourbonomics” in Louisville, Ky. It featured a panel of four bourbon industry experts who answered questions and debated topics on the business side of bourbon and distilled spirits in general. Hosted by the Louisville Business First publication, the event was nearly sold out.

The discussion was quite informative, and the experts didn’t hold back when tackling everything from current market sales to predictions for the future. The panel consisted of:

• Seth DeBolt, director, James B. Beam Institute for Kentucky Spirits, University of Kentucky

• Judith Hollis Jones, CEO and co-founder, Buzzard’s Roost Sipping Whiskeys

• Cordell Lawrence, CEO and co-founder, Eastern Light Distilling; board chair, Kentucky Bourbon Festival

• Susan Wahl, VP of American Whiskeys, Heaven Hill Brands

Current Market Concerns

The declining spirits market has been a topic many have discussed lately, and the overall sentiment from the panelists was it’s a minor market correction from the overconsumption during the pandemic. In fact, all spirits — not just bourbon or whiskey — are reporting lower sales this year.

Cordell Lawrence, CEO of Eastern Light Distilling, added that during the pandemic, bourbon was on a “super cycle” that could not be sustained, so it’s a normal thing for the market to ebb and flow. He also said there was likely a lot of pantry stocking during the pandemic, and that the industry should see normal growth trends soon.

Susan Wahl, VP of American Whiskeys for Heaven Hill, mentioned it might be a good time for distilleries and brands to think outside the box and try to attract new consumers. She attributed the slowdown to the rise of the cannabis industry and the decline of alcohol consumption in younger generations.

“Bourbon is still the darling of the industry when it comes to retailers,” she said. “It is still the consistent performer in the space, and we expect it to continue to be that consistent performer for quite a few years.”

Wahl suggested the industry find ways to reach non-traditional bourbon drinkers, which also involves tapping into export markets.

Judith Hollis Jones, CEO of Buzzard’s Roost, added that reaching female consumers could also help grow bourbon industry, as well as creating unique experiences at distilleries.

Trends in Bourbon

A question was posed to the panelists about emerging trends in the bourbon industry, and among the varied answers was the notion of creating authenticity and transparency in brands. As bourbon fanatics become more interested in mash bills and getting to know the makers of the bourbon, the need for transparency will likely become greater.

Consumers like to feel connected to a brand, and the more information they have about the people and places behind the whiskey, the more that connection grows.

Other trends include variations on mash bills (four grain, single malt and malted rye or some examples), variations on finishing barrels (sherry, wine, rum, tequila, various wood finishes like Amburana, etc.), and an emphasis on sustainability practices.

Predictions for 2025 and Beyond

While this event took place before the 2024 presidential election, it was indeed a topic of discussion — mainly due to the tariffs that could result after Trump takes the office in January of 2025. Since the bourbon industry is looking to expand overseas into markets like India, China, Europe and Japan, these tariffs will definitely become a negative factor if countries decide to retaliate against the U.S.

But tariffs aside, all four panelists remained positive for what 2025 holds for the industry.

“We will continue to adjust,” said Hollis Jones. “This market decline will just force us to work a little harder.”

DeBolt mentioned that consumers will likely see more choices on the shelves, as the aforementioned trends continue to diversify the industry.

According to Wahl, it will be a year of haves and have-nots. “There will likely be pricing pressures and consolidation in the industry,” she said. “Slow and steady wins the race.”

Lawrence agreed, adding, “We will likely see some acquisitions and mergers of companies and brands. We really need to explore international export opportunities. But we’re bullish about the future.”

Optimism is a good sign.